Suppose a municipality has excess funds to invest. It is choosing between the same investments described in the previous example. Government agencies often compute benefit-cost ratios to decide which investment to pursue. Which is best in this case?

Open the portfolio SASHELP.INVSAMP.NVST and compare the investments.

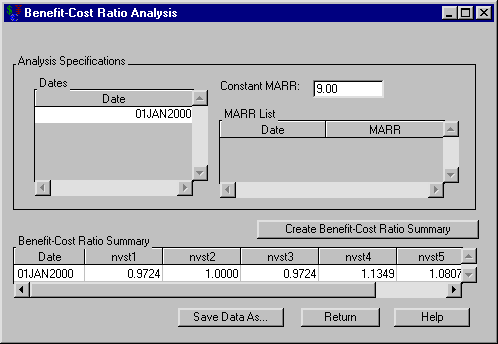

To compute the benefit-cost ratios, follow these steps:

-

Select all five investments.

-

Select Analyze

Benefit-Cost Ratio.

Benefit-Cost Ratio.

-

Enter 01JAN1996 for the Date.

-

Enter 9 for Constant MARR.

-

Click Create Benefit-Cost Ratio Summary to fill the Benefit-Cost Ratio Summary area.

The results displayed in Figure 57.5 indicate that investments 2, 4, and 5 have ratios greater than 1. Therefore, each is profitable with a MARR of 9%.