The UCM Procedure

- Overview

-

Getting Started

-

Syntax

Functional SummaryPROC UCM StatementAUTOREG StatementBLOCKSEASON StatementBY StatementCYCLE StatementDEPLAG StatementESTIMATE StatementFORECAST StatementID StatementIRREGULAR StatementLEVEL StatementMODEL StatementNLOPTIONS StatementOUTLIER StatementRANDOMREG StatementSEASON StatementSLOPE StatementSPLINEREG StatementSPLINESEASON Statement

Functional SummaryPROC UCM StatementAUTOREG StatementBLOCKSEASON StatementBY StatementCYCLE StatementDEPLAG StatementESTIMATE StatementFORECAST StatementID StatementIRREGULAR StatementLEVEL StatementMODEL StatementNLOPTIONS StatementOUTLIER StatementRANDOMREG StatementSEASON StatementSLOPE StatementSPLINEREG StatementSPLINESEASON Statement -

Details

-

Examples

- References

Example 35.5 Trend Removal Using the Hodrick-Prescott Filter

Hodrick-Prescott filter (see Hodrick and Prescott (1997)) is a popular tool in macroeconomics for fitting smooth trend to

time series. It is well known that the trend computation according to this filter is equivalent to fitting the local linear

trend plus irregular model with the level disturbance variance restricted to zero and the slope disturbance variance restricted

to be a suitable multiple of the irregular component variance. The multiple used depends on the frequency of the series; for

example, for quarterly series the commonly recommended multiple is ![]() . For other intervals there is no consensus, but a frequently suggested value for monthly series is

. For other intervals there is no consensus, but a frequently suggested value for monthly series is ![]() and the value for an annual series can range from

and the value for an annual series can range from ![]() to

to ![]() . The data set considered in this example consists of quarterly GNP values for the United States from 1960 to 1991. In the

UCM procedure statements that follow, the presence of the PROFILE option in the ESTIMATE statement implies that the restriction

that the disturbance variance of the slope component be fixed at

. The data set considered in this example consists of quarterly GNP values for the United States from 1960 to 1991. In the

UCM procedure statements that follow, the presence of the PROFILE option in the ESTIMATE statement implies that the restriction

that the disturbance variance of the slope component be fixed at ![]() is interpreted differently: it implies that the disturbance variance of the slope component be restricted to be

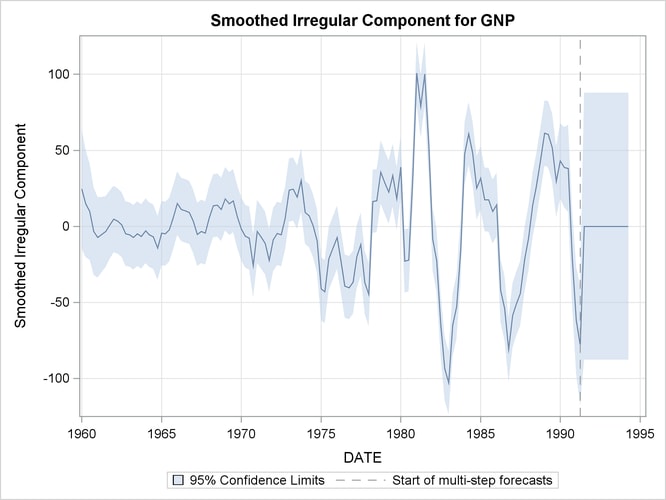

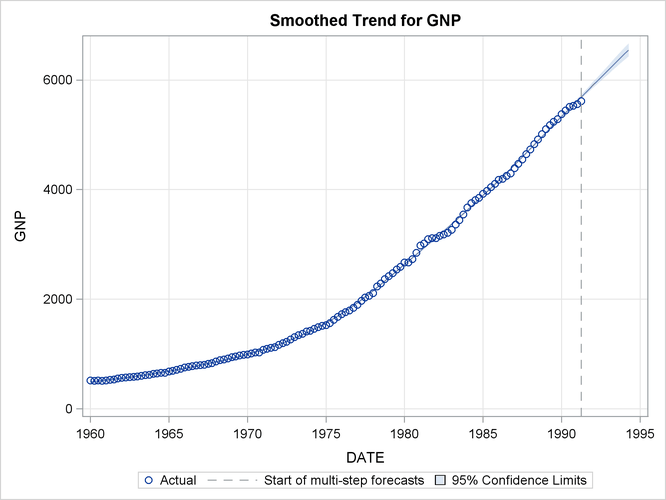

is interpreted differently: it implies that the disturbance variance of the slope component be restricted to be ![]() times the estimated irregular component variance, as needed for the Hodrick-Prescott filter. The plot of the fitted trend is shown

in Output 35.5.1, and the plot of the smoothed irregular component, which corresponds to the detrended series, is given in Output 35.5.2. The detrended series can be further analyzed for business cycles.

times the estimated irregular component variance, as needed for the Hodrick-Prescott filter. The plot of the fitted trend is shown

in Output 35.5.1, and the plot of the smoothed irregular component, which corresponds to the detrended series, is given in Output 35.5.2. The detrended series can be further analyzed for business cycles.

proc ucm data=sashelp.gnp; id date interval=qtr; model gnp; irregular plot=smooth; level var=0 noest plot=smooth; slope var=0.000625 noest; estimate PROFILE; forecast plot=(decomp); run;

Output 35.5.1: Smoothed Trend for the GNP Series as per the Hodrick-Prescott Filter

Output 35.5.2: Detrended GNP Series