The ENTROPY Procedure (Experimental)

- Overview

-

Getting Started

-

Syntax

-

Details

Generalized Maximum EntropyGeneralized Cross EntropyMoment Generalized Maximum EntropyMaximum Entropy-Based Seemingly Unrelated RegressionGeneralized Maximum Entropy for Multinomial Discrete Choice ModelsCensored or Truncated Dependent VariablesInformation MeasuresParameter Covariance For GCEParameter Covariance For GCE-MStatistical TestsMissing ValuesInput Data SetsOutput Data SetsODS Table NamesODS Graphics

Generalized Maximum EntropyGeneralized Cross EntropyMoment Generalized Maximum EntropyMaximum Entropy-Based Seemingly Unrelated RegressionGeneralized Maximum Entropy for Multinomial Discrete Choice ModelsCensored or Truncated Dependent VariablesInformation MeasuresParameter Covariance For GCEParameter Covariance For GCE-MStatistical TestsMissing ValuesInput Data SetsOutput Data SetsODS Table NamesODS Graphics -

Examples

- References

A special case of systems of equations estimation is the pure inverse problem. A pure problem is one that contains an exact relationship between the dependent variable and the independent variables and does not have an error component. A pure inverse problem can be written as

where ![]() is a

is a ![]() -dimensional vector of observations,

-dimensional vector of observations, ![]() is a

is a ![]() matrix of regressors, and

matrix of regressors, and ![]() is a

is a ![]() -dimensional vector of unknowns. Notice that there is no error term.

-dimensional vector of unknowns. Notice that there is no error term.

A classic example is a dice problem (Jaynes, 1963). Given a six-sided die that can take on the values ![]() and the average outcome of the die

and the average outcome of the die ![]() , compute the probabilities

, compute the probabilities ![]() of rolling each number. This infers six values from two pieces of information. The data points are the expected value of

y, and the sum of the probabilities is one. Given

of rolling each number. This infers six values from two pieces of information. The data points are the expected value of

y, and the sum of the probabilities is one. Given ![]() , this problem is solved by using the following SAS code:

, this problem is solved by using the following SAS code:

data one; array x[6] ( 1 2 3 4 5 6 ); y=4.0; run;

proc entropy data=one pure; priors x1 0 1 x2 0 1 x3 0 1 x4 0 1 x5 0 1 x6 0 1; model y = x1-x6/ noint; restrict x1 + x2 +x3 +x4 + x5 + x6 =1; run;

The probabilities are given in Figure 13.16.

Figure 13.16: Jaynes’ Dice Pure Inverse Problem

| Prior Distribution of Parameter T |

| GME Variable Estimates | |||

|---|---|---|---|

| Variable | Estimate | Information Index |

Label |

| x1 | 0.101763 | 0.5254 | |

| x2 | 0.122658 | 0.4630 | |

| x3 | 0.147141 | 0.3974 | |

| x4 | 0.175533 | 0.3298 | |

| x5 | 0.208066 | 0.2622 | |

| x6 | 0.244839 | 0.1970 | |

| Restrict0 | 2.388082 | . | x1 + x2 + x3 + x4 + x5 + x6 = 1 |

Note how the probabilities are skewed to the higher values because of the high average roll provided in the input data.

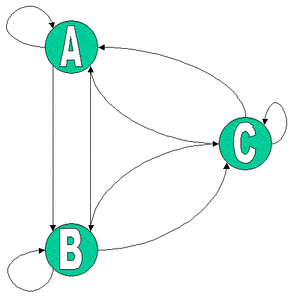

A more useful inverse problem is the first-order markov process. Companies have a share of the marketplace where they do business. Generally, customers for a specific market space can move from company to company. The movement of customers can be visualized graphically as a flow diagram, as in Figure 13.17. The arrows represent movements of customers from one company to another.

You can model the probability that a customer moves from one company to another using a first-order Markov model. Mathematically the model is:

where ![]() is a vector of

is a vector of ![]() market shares at time

market shares at time ![]() and

and ![]() is a

is a ![]() matrix of unknown transition probabilities. The value

matrix of unknown transition probabilities. The value ![]() represents the probability that a customer who is currently using company

represents the probability that a customer who is currently using company ![]() at time

at time ![]() moves to company

moves to company ![]() at time

at time ![]() . The diagonal elements then represent the probability that a customer stays with the current company. The columns in

. The diagonal elements then represent the probability that a customer stays with the current company. The columns in ![]() sum to one.

sum to one.

Given market share information over time, you can estimate the transition probabilities ![]() . In order to estimate

. In order to estimate ![]() using traditional methods, you need at least

using traditional methods, you need at least ![]() observations. If you have fewer than

observations. If you have fewer than ![]() transitions, you can use the ENTROPY procedure to estimate the probabilities.

transitions, you can use the ENTROPY procedure to estimate the probabilities.

Suppose you are studying the market share for four companies. If you want to estimate the transition probabilities for these four companies, you need a time series with four observations of the shares. Assume the current transition probability matrix is as follows:

![\[ \left[ \begin{array}{cccc} 0.7 & 0.4 & 0.0 & 0.1 \\ 0.1 & 0.5 & 0.4 & 0.0 \\ 0.0 & 0.1 & 0.6 & 0.0 \\ 0.2 & 0.0 & 0.0 & 0.9 \end{array} \right] \]](images/etsug_entropy0042.png)

The following SAS DATA step statements generate a series of market shares from this probability matrix. A transition is represented

as the current period shares, y, and the previous period shares, x.

data m;

/* Known Transition matrix */

array p[4,4] (0.7 .4 .0 .1

0.1 .5 .4 .0

0.0 .1 .6 .0

0.2 .0 .0 .9 ) ;

/* Initial Market shares */

array y[4] y1-y4 ( .4 .3 .2 .1 );

array x[4] x1-x4;

drop p1-p16 i;

do i = 1 to 3;

x[1] = y[1]; x[2] = y[2];

x[3] = y[3]; x[4] = y[4];

y[1] = p[1,1] * x1 + p[1,2] * x2 + p[1,3] * x3 + p[1,4] * x4;

y[2] = p[2,1] * x1 + p[2,2] * x2 + p[2,3] * x3 + p[2,4] * x4;

y[3] = p[3,1] * x1 + p[3,2] * x2 + p[3,3] * x3 + p[3,4] * x4;

y[4] = p[4,1] * x1 + p[4,2] * x2 + p[4,3] * x3 + p[4,4] * x4;

output;

end;

run;

The following SAS statements estimate the transition matrix by using only the first transition.

proc entropy markov pure data=m(obs=1); model y1-y4 = x1-x4; run;

The MARKOV option implies NOINT for each model, that the sum of the parameters in each column is one, and chooses support

points of ![]() and

and ![]() . This model can be expressed equivalently as

. This model can be expressed equivalently as

proc entropy pure data=m(obs=1) ; priors y1.x1 0 1 y1.x2 0 1 y1.x3 0 1 y1.x4 0 1; priors y2.x1 0 1 y2.x2 0 1 y2.x3 0 1 y2.x4 0 1; priors y3.x1 0 1 y3.x2 0 1 y3.x3 0 1 y3.x4 0 1; priors y4.x1 0 1 y4.x2 0 1 y4.x3 0 1 y4.x4 0 1; model y1 = x1-x4 / noint; model y2 = x1-x4 / noint; model y3 = x1-x4 / noint; model y4 = x1-x4 / noint; restrict y1.x1 + y2.x1 + y3.x1 + y4.x1 = 1; restrict y1.x2 + y2.x2 + y3.x2 + y4.x2 = 1; restrict y1.x3 + y2.x3 + y3.x3 + y4.x3 = 1; restrict y1.x4 + y2.x4 + y3.x4 + y4.x4 = 1; run;

The transition matrix is given in Figure 13.18.

Figure 13.18: Estimate of ![]() by Using One Transition

by Using One Transition

| Prior Distribution of Parameter T |

| GME Variable Estimates | ||

|---|---|---|

| Variable | Estimate | Information Index |

| y1.x1 | 0.463407 | 0.0039 |

| y1.x2 | 0.41055 | 0.0232 |

| y1.x3 | 0.356272 | 0.0605 |

| y1.x4 | 0.302163 | 0.1161 |

| y2.x1 | 0.272755 | 0.1546 |

| y2.x2 | 0.271459 | 0.1564 |

| y2.x3 | 0.267252 | 0.1625 |

| y2.x4 | 0.260084 | 0.1731 |

| y3.x1 | 0.119926 | 0.4709 |

| y3.x2 | 0.148481 | 0.3940 |

| y3.x3 | 0.180224 | 0.3194 |

| y3.x4 | 0.214394 | 0.2502 |

| y4.x1 | 0.143903 | 0.4056 |

| y4.x2 | 0.169504 | 0.3434 |

| y4.x3 | 0.196252 | 0.2856 |

| y4.x4 | 0.223364 | 0.2337 |

Note that ![]() varies greatly from the true solution.

varies greatly from the true solution.

If two transitions are used instead (OBS=2), the resulting transition matrix is shown in Figure 13.19.

proc entropy markov pure data=m(obs=2); model y1-y4 = x1-x4; run;

Figure 13.19: Estimate of ![]() by Using Two Transitions

by Using Two Transitions

| Prior Distribution of Parameter T |

| GME Variable Estimates | ||

|---|---|---|

| Variable | Estimate | Information Index |

| y1.x1 | 0.721012 | 0.1459 |

| y1.x2 | 0.355703 | 0.0609 |

| y1.x3 | 0.026095 | 0.8256 |

| y1.x4 | 0.096654 | 0.5417 |

| y2.x1 | 0.083987 | 0.5839 |

| y2.x2 | 0.53886 | 0.0044 |

| y2.x3 | 0.373668 | 0.0466 |

| y2.x4 | 0.000133 | 0.9981 |

| y3.x1 | 0.000062 | 0.9990 |

| y3.x2 | 0.099848 | 0.5315 |

| y3.x3 | 0.600104 | 0.0291 |

| y3.x4 | 7.871E-8 | 1.0000 |

| y4.x1 | 0.194938 | 0.2883 |

| y4.x2 | 0.00559 | 0.9501 |

| y4.x3 | 0.000133 | 0.9981 |

| y4.x4 | 0.903214 | 0.5413 |

This transition matrix is much closer to the actual transition matrix.

If, in addition to the transitions, you had other information about the transition matrix, such as your own company’s transition values, that information can be added as restrictions to the parameter estimates. For noisy data, the PURE option should be dropped. Note that this example has six zero probabilities in the transition matrix; the accurate estimation of transition matrices with fewer zero probabilities generally requires more transition observations.