Computations

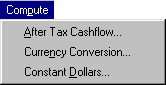

Figure 57.1 shows the Compute menu.

The Compute menu offers the following options that apply to generic cashflows.

After Tax Cashflow opens the After Tax Cashflow Calculation

dialog box. Computing an after tax cashflow is useful when taxes affect investment alternatives differently. Comparing after

tax cashflows provides a more accurate determination of the cashflows’ profitabilities. You can set default values for income

tax rates by selecting Tools ![]() Define Rate

Define Rate ![]() Income Tax Rate from the Investment Analysis dialog box. This opens the Income Tax Specification

dialog box where you can enter the tax rates.

Income Tax Rate from the Investment Analysis dialog box. This opens the Income Tax Specification

dialog box where you can enter the tax rates.

Currency Conversion opens the Currency Conversion dialog box. Currency conversion is necessary when investments are in different currencies. For data concerning currency conversion rates, see http://dsbb.imf.org/, the International Monetary Fund’s Dissemination Standards Bulletin Board.

Constant Dollars opens the Constant Dollar Calculation

dialog box. A constant dollar (inflation adjusted monetary value) calculation takes cashflow and inflation information and

discounts the cashflow to a level where the buying power of the monetary unit is constant over time. Groups quantify inflation

(in the form of price indices and inflation rates) for countries and industries by averaging the growth of prices for various

products and sectors of the economy. For data concerning price indices, see the United States Department of Labor at http://www.dol.gov/ and the International Monetary Fund’s Dissemination Standards Bulletin Board at http://dsbb.imf.org/. You can set default values for inflation rates by clicking Tools ![]() Define Rate

Define Rate ![]() Inflation from the Investment Analysis dialog box. This opens the Inflation Specification

dialog box where you can enter the inflation rates.

Inflation from the Investment Analysis dialog box. This opens the Inflation Specification

dialog box where you can enter the inflation rates.