The AUTOREG Procedure

- Overview

-

Getting Started

-

Syntax

-

Details

Missing ValuesAutoregressive Error ModelAlternative Autocorrelation Correction MethodsGARCH ModelsHeteroscedasticity- and Autocorrelation-Consistent Covariance Matrix EstimatorGoodness-of-Fit Measures and Information CriteriaTestingPredicted ValuesOUT= Data SetOUTEST= Data SetPrinted OutputODS Table NamesODS Graphics

Missing ValuesAutoregressive Error ModelAlternative Autocorrelation Correction MethodsGARCH ModelsHeteroscedasticity- and Autocorrelation-Consistent Covariance Matrix EstimatorGoodness-of-Fit Measures and Information CriteriaTestingPredicted ValuesOUT= Data SetOUTEST= Data SetPrinted OutputODS Table NamesODS Graphics -

Examples

- References

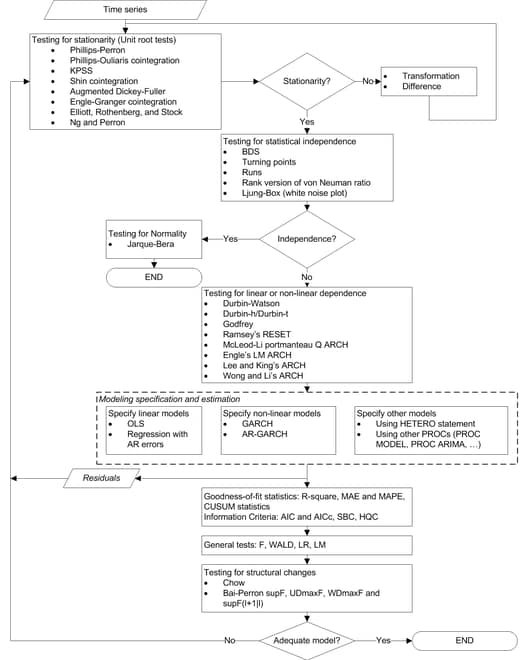

The modeling process consists of four stages: identification, specification, estimation, and diagnostic checking (Cromwell, Labys, and Terraza, 1994). The AUTOREG procedure supports tens of statistical tests for identification and diagnostic checking. Figure 8.15 illustrates how to incorporate these statistical tests into the modeling process.

Most of the theories of time series require stationarity; therefore, it is critical to determine whether a time series is stationary. Two nonstationary time series are fractionally integrated time series and autoregressive series with random coefficients. However, more often some time series are nonstationary due to an upward trend over time. The trend can be captured by either of the following two models.

-

The difference stationary process

![\[ (1- L)y_ t =\delta +\psi (L) \epsilon _ t \]](images/etsug_autoreg0402.png)

where

is the lag operator,

is the lag operator,  , and

, and  is a white noise sequence with mean zero and variance

is a white noise sequence with mean zero and variance  . Hamilton (1994) also refers to this model the unit root process.

. Hamilton (1994) also refers to this model the unit root process.

-

The trend stationary process

![\[ y_ t =\alpha +\delta t +\psi (L) \epsilon _ t \]](images/etsug_autoreg0406.png)

When a process has a unit root, it is said to be integrated of order one or I(1). An I(1) process is stationary after differencing once. The trend stationary process and difference stationary process require different treatment to transform the process into stationary one for analysis. Therefore, it is important to distinguish the two processes. Bhargava (1986) nested the two processes into the following general model

However, a difficulty is that the right-hand side is nonlinear in the parameters. Therefore, it is convenient to use a different parametrization

The test of null hypothesis that ![]() against the one-sided alternative of

against the one-sided alternative of ![]() is called a unit root test.

is called a unit root test.

Dickey-Fuller unit root tests are based on regression models similar to the previous model

where ![]() is assumed to be white noise. The t statistic of the coefficient

is assumed to be white noise. The t statistic of the coefficient ![]() does not follow the normal distribution asymptotically. Instead, its distribution can be derived using the functional central

limit theorem. Three types of regression models including the preceding one are considered by the Dickey-Fuller test. The

deterministic terms that are included in the other two types of regressions are either null or constant only.

does not follow the normal distribution asymptotically. Instead, its distribution can be derived using the functional central

limit theorem. Three types of regression models including the preceding one are considered by the Dickey-Fuller test. The

deterministic terms that are included in the other two types of regressions are either null or constant only.

An assumption in the Dickey-Fuller unit root test is that it requires the errors in the autoregressive model to be white noise, which is often not true. There are two popular ways to account for general serial correlation between the errors. One is the augmented Dickey-Fuller (ADF) test, which uses the lagged difference in the regression model. This was originally proposed by Dickey and Fuller (1979) and later studied by Said and Dickey (1984) and Phillips and Perron (1988). Another method is proposed by Phillips and Perron (1988); it is called Phillips-Perron (PP) test. The tests adopt the original Dickey-Fuller regression with intercept, but modify the test statistics to take account of the serial correlation and heteroscedasticity. It is called nonparametric because no specific form of the serial correlation of the errors is assumed.

A problem of the augmented Dickey-Fuller and Phillips-Perron unit root tests is that they are subject to size distortion and low power. It is reported in Schwert (1989) that the size distortion is significant when the series contains a large moving average (MA) parameter. DeJong et al. (1992) find that the ADF has power around one third and PP test has power less than 0.1 against the trend stationary alternative, in some common settings. Among some more recent unit root tests that improve upon the size distortion and the low power are the tests described by Elliott, Rothenberg, and Stock (1996) and Ng and Perron (2001). These tests involve a step of detrending before constructing the test statistics and are demonstrated to perform better than the traditional ADF and PP tests.

Most testing procedures specify the unit root processes as the null hypothesis. Tests of the null hypothesis of stationarity have also been studied, among which Kwiatkowski et al. (1992) is very popular.

Economic theories often dictate that a group of economic time series are linked together by some long-run equilibrium relationship.

Statistically, this phenomenon can be modeled by cointegration. When several nonstationary processes ![]() are cointegrated, there exists a

are cointegrated, there exists a ![]() cointegrating vector

cointegrating vector ![]() such that

such that ![]() is stationary and

is stationary and ![]() is a nonzero vector. One way to test the relationship of cointegration is the residual based cointegration test, which assumes the regression model

is a nonzero vector. One way to test the relationship of cointegration is the residual based cointegration test, which assumes the regression model

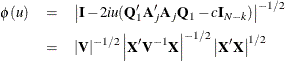

where ![]() ,

, ![]() , and

, and ![]() = (

= (![]()

![]() ,

,![]() ,

,![]()

![]() . The OLS residuals from the regression model are used to test for the null hypothesis of no cointegration. Engle and Granger

(1987) suggest using ADF on the residuals while Phillips and Ouliaris (1990) study the tests using PP and other related test statistics.

. The OLS residuals from the regression model are used to test for the null hypothesis of no cointegration. Engle and Granger

(1987) suggest using ADF on the residuals while Phillips and Ouliaris (1990) study the tests using PP and other related test statistics.

Common unit root tests have the null hypothesis that there is an autoregressive unit root ![]() , and the alternative is

, and the alternative is ![]() , where

, where ![]() is the autoregressive coefficient of the time series

is the autoregressive coefficient of the time series

This is referred to as the zero mean model. The standard Dickey-Fuller (DF) test assumes that errors ![]() are white noise. There are two other types of regression models that include a constant or a time trend as follows:

are white noise. There are two other types of regression models that include a constant or a time trend as follows:

These two models are referred to as the constant mean model and the trend model, respectively. The constant mean model includes

a constant mean ![]() of the time series. However, the interpretation of

of the time series. However, the interpretation of ![]() depends on the stationarity in the following sense: the mean in the stationary case when

depends on the stationarity in the following sense: the mean in the stationary case when ![]() is the trend in the integrated case when

is the trend in the integrated case when ![]() . Therefore, the null hypothesis should be the joint hypothesis that

. Therefore, the null hypothesis should be the joint hypothesis that ![]() and

and ![]() . However for the unit root tests, the test statistics are concerned with the null hypothesis of

. However for the unit root tests, the test statistics are concerned with the null hypothesis of ![]() . The joint null hypothesis is not commonly used. This issue is address in Bhargava (1986) with a different nesting model.

. The joint null hypothesis is not commonly used. This issue is address in Bhargava (1986) with a different nesting model.

There are two types of test statistics. The conventional t ratio is

and the second test statistic, called ![]() -test, is

-test, is

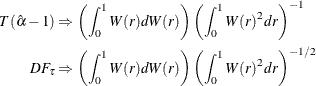

For the zero mean model, the asymptotic distributions of the Dickey-Fuller test statistics are

For the constant mean model, the asymptotic distributions are

![\begin{align*} T(\hat{\alpha }-1) & \Rightarrow \left( [W(1)^2-1]/2 -W(1)\int _0^1 W(r)dr \right)\left( \int _0^1 W(r)^2 dr - \left(\int _0^1 W(r)dr \right)^2\right)^{-1}\\ DF_\tau & \Rightarrow \left([W(1)^2-1]/2 -W(1)\int _0^1 W(r)dr \right)\left( \int _0^1 W(r)^2 dr - \left(\int _0^1 W(r)dr \right)^2\right)^{-1/2} \end{align*}](images/etsug_autoreg0432.png)

For the trend model, the asymptotic distributions are

![\begin{equation*} \begin{split} T(\hat{\alpha }-1) & \Rightarrow \left[ W(r)dW +12\left(\int _0^1 rW(r)dr -\frac{1}{2}\int _0^1 W(r)dr \right) \left( \int _0^1 W(r)dr - \frac12 W(1)\right) \right. \\ & \quad \left. -W(1) \int _0^1 W(r)dr \right] D^{-1} \\ DF_\tau & \Rightarrow \left[ W(r)dW +12\left(\int _0^1 rW(r)dr -\frac{1}{2}\int _0^1 W(r)dr \right) \left( \int _0^1 W(r)dr - \frac12 W(1)\right) \right. \\ & \quad \left. -W(1) \int _0^1 W(r)dr \right] D^{1/2} \end{split}\end{equation*}](images/etsug_autoreg0433.png)

where

One problem of the Dickey-Fuller and similar tests that employ three types of regressions is the difficulty in the specification of the deterministic trends. Campbell and Perron (1991) claimed that "the proper handling of deterministic trends is a vital prerequisite for dealing with unit roots". However the "proper handling" is not obvious since the distribution theory of the relevant statistics about the deterministic trends is not available. Hayashi (2000) suggests to using the constant mean model when you think there is no trend, and using the trend model when you think otherwise. However no formal procedure is provided.

The null hypothesis of the Dickey-Fuller test is a random walk, possibly with drift. The differenced process is not serially correlated under the null of I(1). There is a great need for the generalization of this specification. The augmented Dickey-Fuller (ADF) test, originally proposed in Dickey and Fuller (1979), adjusts for the serial correlation in the time series by adding lagged first differences to the autoregressive model,

where the deterministic terms ![]() and

and ![]() can be absent for the models without drift or linear trend. As previously, there are two types of test statistics. One is

the OLS t value

can be absent for the models without drift or linear trend. As previously, there are two types of test statistics. One is

the OLS t value

and the other is given by

The asymptotic distributions of the test statistics are the same as those of the standard Dickey-Fuller test statistics.

Nonstationary multivariate time series can be tested for cointegration, which means that a linear combination of these time

series is stationary. Formally, denote the series by ![]() . The null hypothesis of cointegration is that there exists a vector

. The null hypothesis of cointegration is that there exists a vector ![]() such that

such that ![]() is stationary. Residual-based cointegration tests were studied in Engle and Granger (1987) and Phillips and Ouliaris (1990). The latter are described in the next subsection. The first step regression is

is stationary. Residual-based cointegration tests were studied in Engle and Granger (1987) and Phillips and Ouliaris (1990). The latter are described in the next subsection. The first step regression is

where ![]() ,

, ![]() , and

, and ![]() = (

= (![]()

![]() ,

,![]() ,

,![]()

![]() . This regression can also include an intercept or an intercept with a linear trend. The residuals are used to test for the

existence of an autoregressive unit root. Engle and Granger (1987) proposed augmented Dickey-Fuller type regression without an intercept on the residuals to test the unit root. When the first

step OLS does not include an intercept, the asymptotic distribution of the ADF test statistic

. This regression can also include an intercept or an intercept with a linear trend. The residuals are used to test for the

existence of an autoregressive unit root. Engle and Granger (1987) proposed augmented Dickey-Fuller type regression without an intercept on the residuals to test the unit root. When the first

step OLS does not include an intercept, the asymptotic distribution of the ADF test statistic ![]() is given by

is given by

where ![]() is a k vector standard Brownian motion and

is a k vector standard Brownian motion and

is a partition such that ![]() is a scalar and

is a scalar and ![]() is

is ![]() dimensional. The asymptotic distributions of the test statistics in the other two cases have the same form as the preceding

formula. If the first step regression includes an intercept, then

dimensional. The asymptotic distributions of the test statistics in the other two cases have the same form as the preceding

formula. If the first step regression includes an intercept, then ![]() is replaced by the demeaned Brownian motion

is replaced by the demeaned Brownian motion ![]() . If the first step regression includes a time trend, then

. If the first step regression includes a time trend, then ![]() is replaced by the detrended Brownian motion. The critical values of the asymptotic distributions are tabulated in Phillips

and Ouliaris (1990) and MacKinnon (1991).

is replaced by the detrended Brownian motion. The critical values of the asymptotic distributions are tabulated in Phillips

and Ouliaris (1990) and MacKinnon (1991).

The residual based cointegration tests have a major shortcoming. Different choices of the dependent variable in the first

step OLS might produce contradictory results. This can be explained theoretically. If the dependent variable is in the cointegration

relationship, then the test is consistent against the alternative that there is cointegration. On the other hand, if the dependent

variable is not in the cointegration system, the OLS residual ![]() do not converge to a stationary process. Changing the dependent variable is more likely to produce conflicting results in

finite samples.

do not converge to a stationary process. Changing the dependent variable is more likely to produce conflicting results in

finite samples.

Besides the ADF test, there is another popular unit root test that is valid under general serial correlation and heteroscedasticity,

developed by Phillips (1987) and Phillips and Perron (1988). The tests are constructed using the AR(1) type regressions, unlike ADF tests, with corrected estimation of the long run

variance of ![]() . In the case without intercept, consider the driftless random walk process

. In the case without intercept, consider the driftless random walk process

where the disturbances might be serially correlated with possible heteroscedasticity. Phillips and Perron (1988) proposed the unit root test of the OLS regression model,

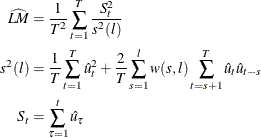

Denote the OLS residual by ![]() . The asymptotic variance of

. The asymptotic variance of ![]() can be estimated by using the truncation lag l.

can be estimated by using the truncation lag l.

where ![]() ,

, ![]() for

for ![]() , and

, and ![]() . This is a consistent estimator suggested by Newey and West (1987).

. This is a consistent estimator suggested by Newey and West (1987).

The variance of ![]() can be estimated by

can be estimated by ![]() . Let

. Let ![]() be the variance estimate of the OLS estimator

be the variance estimate of the OLS estimator ![]() . Then the Phillips-Perron

. Then the Phillips-Perron ![]() test (zero mean case) is written

test (zero mean case) is written

The ![]() statistic is just the ordinary Dickey-Fuller

statistic is just the ordinary Dickey-Fuller ![]() statistic with a correction term that accounts for the serial correlation. The correction term goes to zero asymptotically

if there is no serial correlation.

statistic with a correction term that accounts for the serial correlation. The correction term goes to zero asymptotically

if there is no serial correlation.

Note that ![]() as

as ![]() , which shows that the limiting distribution is skewed to the left.

, which shows that the limiting distribution is skewed to the left.

Let ![]() be the

be the ![]() statistic for

statistic for ![]() . The Phillips-Perron

. The Phillips-Perron ![]() (defined here as

(defined here as ![]() ) test is written

) test is written

To incorporate a constant intercept, the regression model ![]() is used (single mean case) and null hypothesis the series is a driftless random walk with nonzero unconditional mean. To

incorporate a time trend, we used the regression model

is used (single mean case) and null hypothesis the series is a driftless random walk with nonzero unconditional mean. To

incorporate a time trend, we used the regression model ![]() and under the null the series is a random walk with drift.

and under the null the series is a random walk with drift.

The limiting distributions of the test statistics for the zero mean case are

![\begin{align*} \hat{\mr{Z}}_{\rho } & \Rightarrow \frac{\frac{1}{2}\{ {\mi{B} (1)} ^{2}-1\} }{\int _{0}^{1}{{[\mi{B} (s)} ]^{2}ds}} \\ \hat{\mr{Z}}_\tau & \Rightarrow \frac{\frac{1}{2}\{ {[\mi{B} (1)} ]^{2}-1\} }{\{ \int _{0}^{1}{{[\mi{B} (x)} ]^{2}dx}\} ^{1/2} } \end{align*}](images/etsug_autoreg0473.png)

where B(![]() ) is a standard Brownian motion.

) is a standard Brownian motion.

The limiting distributions of the test statistics for the intercept case are

![\begin{align*} \hat{Z}_{\rho } & \Rightarrow \frac{\frac{1}{2}\{ {[\mi{B} (1)} ]^{2}-1\} -\mi{B} (1)\int _{0}^{1}{\mi{B} (x)dx}}{\int _{0}^{1}{{[\mi{B} (x)} ]^{2}dx} -\left[{\int _{0}^{1}{\mi{B} (x)dx}}\right]^{2}} \\ {\hat{\mr{Z}}_\tau } & \Rightarrow \frac{\frac{1}{2}\{ {[\mi{B} (1)} ]^{2}-1\} -\mi{B} (1)\int _{0}^{1}{\mi{B} (x)dx}}{{\{ \int _{0}^{1}{{[\mi{B} (x)}]^{2}dx} -\left[{\int _{0}^{1}{\mi{B} (x)dx}}\right]^{2} }\} ^{1/2} } \end{align*}](images/etsug_autoreg0475.png)

Finally, The limiting distributions of the test statistics for the trend case are can be derived as

![\[ \begin{bmatrix} 0 & c & 0 \end{bmatrix} V^{-1} \begin{bmatrix} \mi{B} (1) \\ \left({\mi{B} (1)}^{2}-1 \right)/2 \\ \mi{B} (1)-\int _{0}^{1}{\mi{B} (x)dx} \end{bmatrix} \]](images/etsug_autoreg0476.png)

where ![]() for

for ![]() and

and ![]() for

for ![]() ,

,

![\[ V = \left[\begin{matrix} 1 & \int _{0}^{1}{\mi{B} (x)dx} & 1/2 \\ \int _{0}^{1}{\mi{B} (x)dx} & \int _{0}^{1}{{\mi{B} (x)} ^{2}dx} & \int _{0}^{1}{x\mi{B} (x)dx} \\ 1/2 & \int _{0}^{1}{x\mi{B} (x)dx} & 1/3 \end{matrix}\right] \]](images/etsug_autoreg0479.png)

The finite sample performance of the PP test is not satisfactory ( see Hayashi (2000) ).

When several variables ![]() are cointegrated, there exists a

are cointegrated, there exists a ![]() cointegrating vector

cointegrating vector ![]() such that

such that ![]() is stationary and

is stationary and ![]() is a nonzero vector. The residual based cointegration test assumes the following regression model:

is a nonzero vector. The residual based cointegration test assumes the following regression model:

where ![]() ,

, ![]() , and

, and ![]() = (

= (![]()

![]() ,

,![]() ,

,![]()

![]() . You can estimate the consistent cointegrating vector by using OLS if all variables are difference stationary — that is,

I(1). The estimated cointegrating vector is

. You can estimate the consistent cointegrating vector by using OLS if all variables are difference stationary — that is,

I(1). The estimated cointegrating vector is ![]() . The Phillips-Ouliaris test is computed using the OLS residuals from the preceding regression model, and it uses the PP unit

root tests

. The Phillips-Ouliaris test is computed using the OLS residuals from the preceding regression model, and it uses the PP unit

root tests ![]() and

and ![]() developed in Phillips (1987), although in Phillips and Ouliaris (1990) the asymptotic distributions of some other leading unit root tests are also derived. The null hypothesis is no cointegration.

developed in Phillips (1987), although in Phillips and Ouliaris (1990) the asymptotic distributions of some other leading unit root tests are also derived. The null hypothesis is no cointegration.

You need to refer to the tables by Phillips and Ouliaris (1990) to obtain the p-value of the cointegration test. Before you apply the cointegration test, you may want to perform the unit root test for each variable (see the option STATIONARITY= ).

As in the Engle-Granger cointegration tests, the Phillips-Ouliaris test can give conflicting results for different choices of the regressand. There are other cointegration tests that are invariant to the order of the variables, including Johansen (1988), Johansen (1991), Stock and Watson (1988).

As mentioned earlier, ADF and PP both suffer severe size distortion and low power. There is a class of newer tests that improve both size and power. These are sometimes called efficient unit root tests, and among them tests by Elliott, Rothenberg, and Stock (1996) and Ng and Perron (2001) are prominent.

Elliott, Rothenberg, and Stock (1996) consider the data generating process

where ![]() is either

is either ![]() or

or ![]() and

and ![]() is an unobserved stationary zero-mean process with positive spectral density at zero frequency. The null hypothesis is

is an unobserved stationary zero-mean process with positive spectral density at zero frequency. The null hypothesis is ![]() , and the alternative is

, and the alternative is ![]() . The key idea of Elliott, Rothenberg, and Stock (1996) is to study the asymptotic power and asymptotic power envelope of some new tests. Asymptotic power is defined with a sequence

of local alternatives. For a fixed alternative hypothesis, the power of a test usually goes to one when sample size goes to

infinity; however, this says nothing about the finite sample performance. On the other hand, when the data generating process

under the alternative moves closer to the null hypothesis as the sample size increases, the power does not necessarily converge

to one. The local-to-unity alternatives in ERS are

. The key idea of Elliott, Rothenberg, and Stock (1996) is to study the asymptotic power and asymptotic power envelope of some new tests. Asymptotic power is defined with a sequence

of local alternatives. For a fixed alternative hypothesis, the power of a test usually goes to one when sample size goes to

infinity; however, this says nothing about the finite sample performance. On the other hand, when the data generating process

under the alternative moves closer to the null hypothesis as the sample size increases, the power does not necessarily converge

to one. The local-to-unity alternatives in ERS are

and the power against the local alternatives has a limit as ![]() goes to infinity, which is called asymptotic power. This value is strictly between 0 and 1. Asymptotic power indicates the

adequacy of a test to distinguish small deviations from the null hypothesis.

goes to infinity, which is called asymptotic power. This value is strictly between 0 and 1. Asymptotic power indicates the

adequacy of a test to distinguish small deviations from the null hypothesis.

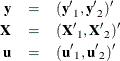

Define

Let ![]() be the sum of squared residuals from a least squares regression of

be the sum of squared residuals from a least squares regression of ![]() on

on ![]() . Then the point optimal test against the local alternative

. Then the point optimal test against the local alternative ![]() has the form

has the form

where ![]() is an estimator for

is an estimator for ![]() . The test rejects the null when

. The test rejects the null when ![]() is small. The asymptotic power function for the point optimal test that is constructed with

is small. The asymptotic power function for the point optimal test that is constructed with ![]() under local alternatives with c is denoted by

under local alternatives with c is denoted by ![]() . Then the power envelope is

. Then the power envelope is ![]() because the test formed with

because the test formed with ![]() is the most powerful against the alternative

is the most powerful against the alternative ![]() . In other words, the asymptotic function

. In other words, the asymptotic function ![]() is always below the power envelope

is always below the power envelope ![]() except that at one point,

except that at one point, ![]() , they are tangent. Elliott, Rothenberg, and Stock (1996) show that choosing some specific values for

, they are tangent. Elliott, Rothenberg, and Stock (1996) show that choosing some specific values for ![]() can cause the asymptotic power function

can cause the asymptotic power function ![]() of the point optimal test to be very close to the power envelope. The optimal

of the point optimal test to be very close to the power envelope. The optimal ![]() is

is ![]() when

when ![]() , and

, and ![]() when

when ![]() . This choice of

. This choice of ![]() corresponds to the tangent point where

corresponds to the tangent point where ![]() . This is also true of the DF-GLS test.

. This is also true of the DF-GLS test.

Elliott, Rothenberg, and Stock (1996) also propose the DF-GLS test, given by the t statistic for testing ![]() in the regression

in the regression

where ![]() is obtained in a first step detrending

is obtained in a first step detrending

and ![]() is least squares regression coefficient of

is least squares regression coefficient of ![]() on

on ![]() . Regarding the lag length selection, Elliott, Rothenberg, and Stock (1996) favor the Schwarz Bayesian information criterion. The optimal selection of the lag length p and the estimation of

. Regarding the lag length selection, Elliott, Rothenberg, and Stock (1996) favor the Schwarz Bayesian information criterion. The optimal selection of the lag length p and the estimation of ![]() is further discussed in Ng and Perron (2001). The lag length is selected from the interval

is further discussed in Ng and Perron (2001). The lag length is selected from the interval ![]() for some fixed

for some fixed ![]() by using the modified Akaike’s information criterion,

by using the modified Akaike’s information criterion,

where ![]() and

and ![]() . For fixed lag length p, an estimate of

. For fixed lag length p, an estimate of ![]() is given by

is given by

![\[ \hat{\omega }^2= \frac{(T-1-p)^{-1} \sum _{t=p+2}^{T} \hat{\epsilon }_{tp}^2 }{ \left(1- \sum _{j=1}^ p \hat{\psi }_ j \right)^2} \]](images/etsug_autoreg0520.png)

DF-GLS is indeed a superior unit root test, according to Stock (1994), Schwert (1989), and Elliott, Rothenberg, and Stock (1996). In terms of the size of the test, DF-GLS is almost as good as the ADF t test ![]() and better than the PP

and better than the PP ![]() and

and ![]() test. In addition, the power of the DF-GLS test is greater than that of both the ADF t test and the

test. In addition, the power of the DF-GLS test is greater than that of both the ADF t test and the ![]() -test.

-test.

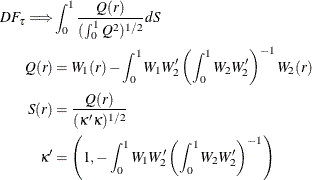

Ng and Perron (2001) also apply GLS detrending to obtain the following M-tests:

The first one is a modified version of the Phillips-Perron ![]() test,

test,

where the detrended data ![]() is used. The second is a modified Bhargava (1986)

is used. The second is a modified Bhargava (1986) ![]() test statistic. The third can be perceived as a modified Phillips-Perron

test statistic. The third can be perceived as a modified Phillips-Perron ![]() statistic because of the relationship

statistic because of the relationship ![]() .

.

The modified point optimal tests that use the GLS detrended data are

![\[ \begin{array}{ll} MP_ T^{GLS}=\frac{ \bar{c}^2(T-1)^{-2} \sum _{t=1}^{T-1} (y_{t}^ d)^2 -\bar{c} (T-1)^{-1} (y_{T}^ d)^2}{\hat{\omega }^2} \quad & \text {for} \; z_ t =1 \\ MP_ T^{GLS}=\frac{ \bar{c}^2(T-1)^{-2} \sum _{t=1}^{T-1} (y_{t}^ d)^2 +(1-\bar{c}) (T-1)^{-1} (y_{T}^ d)^2}{\hat{\omega }^2}\quad & \text {for}\; z_ t =(1,t) \\ \end{array} \]](images/etsug_autoreg0531.png)

The DF-GLS test and the ![]() test have the same limiting distribution:

test have the same limiting distribution:

![\[ \begin{array}{ll} \text {DF-GLS} \approx MZ_ t \Rightarrow 0.5\frac{(J_ c(1)^2 -1)}{ \left(\int _0^1 J_ c(r)^2dr \right)^{1/2}} \quad & \text {for} \; z_ t =1\\ \text {DF-GLS} \approx MZ_ t \Rightarrow 0.5\frac{(V_{c,\bar{c}}(1)^2 -1)}{\left( \int _0^1 V_{c,\bar{c}}(r)^2dr \right)^{1/2}} \quad & \text {for}\; z_ t =(1,t)\\ \end{array} \]](images/etsug_autoreg0533.png)

The point optimal test and the modified point optimal test have the same limiting distribution:

where ![]() is a standard Brownian motion and

is a standard Brownian motion and ![]() is an Ornstein-Uhlenbeck process defined by

is an Ornstein-Uhlenbeck process defined by ![]() with

with ![]() ,

, ![]() , and

, and ![]() .

.

Overall, the M-tests have the smallest size distortion, with the ADF t test having the next smallest. The ADF ![]() -test,

-test, ![]() , and

, and ![]() have the largest size distortion. In addition, the power of the DF-GLS and M-tests is greater than that of the ADF t test and

have the largest size distortion. In addition, the power of the DF-GLS and M-tests is greater than that of the ADF t test and ![]() -test. The ADF

-test. The ADF ![]() has more severe size distortion than the ADF

has more severe size distortion than the ADF ![]() , but it has more power for a fixed lag length.

, but it has more power for a fixed lag length.

There are fewer tests available for the null hypothesis of trend stationarity I(0). The main reason is the difficulty of theoretical

development. The KPSS test was introduced in Kwiatkowski et al. (1992) to test the null hypothesis that an observable series is stationary around a deterministic trend. For consistency, the notation

used here differs from the notation in the original paper. The setup of the problem is as follows: it is assumed that the

series is expressed as the sum of the deterministic trend, random walk ![]() , and stationary error

, and stationary error ![]() ; that is,

; that is,

where ![]() iid

iid ![]() , and an intercept

, and an intercept ![]() (in the original paper, the authors use

(in the original paper, the authors use ![]() instead of

instead of ![]() ; here we assume

; here we assume ![]() .) The null hypothesis of trend stationarity is specified by

.) The null hypothesis of trend stationarity is specified by ![]() , while the null of level stationarity is the same as above with the model restriction

, while the null of level stationarity is the same as above with the model restriction ![]() . Under the alternative that

. Under the alternative that ![]() , there is a random walk component in the observed series

, there is a random walk component in the observed series ![]() .

.

Under stronger assumptions of normality and iid of ![]() and

and ![]() , a one-sided LM test of the null that there is no random walk (

, a one-sided LM test of the null that there is no random walk (![]() ) can be constructed as follows:

) can be constructed as follows:

Under the null hypothesis, ![]() can be estimated by ordinary least squares regression of

can be estimated by ordinary least squares regression of ![]() on an intercept and the time trend. Following the original work of Kwiatkowski et al. (1992), under the null (

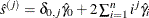

on an intercept and the time trend. Following the original work of Kwiatkowski et al. (1992), under the null (![]() ), the

), the ![]() statistic converges asymptotically to three different distributions depending on whether the model is trend-stationary, level-stationary

(

statistic converges asymptotically to three different distributions depending on whether the model is trend-stationary, level-stationary

(![]() ), or zero-mean stationary (

), or zero-mean stationary (![]() ,

, ![]() ). The trend-stationary model is denoted by subscript

). The trend-stationary model is denoted by subscript ![]() and the level-stationary model is denoted by subscript

and the level-stationary model is denoted by subscript ![]() . The case when there is no trend and zero intercept is denoted as 0. The last case, although rarely used in practice, is

considered in Hobijn, Franses, and Ooms (2004):

. The case when there is no trend and zero intercept is denoted as 0. The last case, although rarely used in practice, is

considered in Hobijn, Franses, and Ooms (2004):

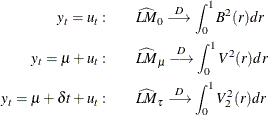

with

where ![]() is a Brownian motion (Wiener process) and

is a Brownian motion (Wiener process) and ![]() is convergence in distribution.

is convergence in distribution. ![]() is a standard Brownian bridge, and

is a standard Brownian bridge, and ![]() is a second-level Brownian bridge.

is a second-level Brownian bridge.

Using the notation of Kwiatkowski et al. (1992), the ![]() statistic is named as

statistic is named as ![]() . This test depends on the computational method used to compute the long-run variance

. This test depends on the computational method used to compute the long-run variance ![]() ; that is, the window width l and the kernel type

; that is, the window width l and the kernel type ![]() . You can specify the kernel used in the test by using the KERNEL option:

. You can specify the kernel used in the test by using the KERNEL option:

-

Newey-West/Bartlett (KERNEL=NW

BART) (this is the default)

BART) (this is the default)

![\[ w(s,l)=1-\frac{s}{l+1} \]](images/etsug_autoreg0120.png)

-

quadratic spectral (KERNEL=QS)

![\[ w(s,l) = \tilde{w}\left(\frac sl\right)=\tilde{w}(x)=\frac{25}{12\pi ^2 x^2}\left(\frac{\sin \left(6\pi x/5\right)}{6\pi x/5}-\cos \left( \frac65\pi x\right)\right) \]](images/etsug_autoreg0567.png)

You can specify the number of lags, l, in three different ways:

-

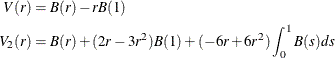

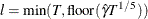

Schwert (SCHW = c) (default for NW, c=12)

![\[ l=\max \left\{ 1,\text {floor}\left[c\left(\frac{T}{100}\right)^{1/4}\right]\right\} \]](images/etsug_autoreg0122.png)

-

manual (LAG = l)

-

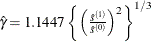

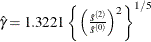

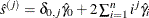

automatic selection (AUTO) (default for QS), from Hobijn, Franses, and Ooms (2004). The number of lags, l, is calculated as in the following table:

KERNEL=NW

KERNEL=QS

where

is the number of observations,

is the number of observations,  if

if  and 0 otherwise, and

and 0 otherwise, and  .

.

Simulation evidence shows that the KPSS has size distortion in finite samples. For an example, see Caner and Kilian (2001). The power is reduced when the sample size is large; this can be derived theoretically (see Breitung (1995)). Another problem of the KPSS test is that the power depends on the truncation lag used in the Newey-West estimator of the

long-run variance ![]() .

.

Shin (1994) extends the KPSS test to incorporate the regressors to be a cointegration test. The cointegrating regression becomes

where ![]() and

and ![]() are scalar and m-vector

are scalar and m-vector ![]() variables. There are still three cases of cointegrating regressions: without intercept and trend, with intercept only, and

with intercept and trend. The null hypothesis of the cointegration test is the same as that for the KPSS test,

variables. There are still three cases of cointegrating regressions: without intercept and trend, with intercept only, and

with intercept and trend. The null hypothesis of the cointegration test is the same as that for the KPSS test, ![]() . The test statistics for cointegration in the three cases of cointegrating regressions are exactly the same as those in the

KPSS test; these test statistics are then ignored here. Under the null hypothesis, the statistics converge asymptotically

to three different distributions:

. The test statistics for cointegration in the three cases of cointegrating regressions are exactly the same as those in the

KPSS test; these test statistics are then ignored here. Under the null hypothesis, the statistics converge asymptotically

to three different distributions:

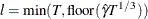

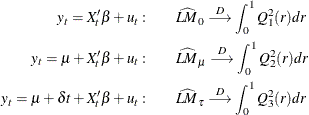

with

where ![]() and

and ![]() are independent scalar and m-vector standard Brownian motion, and

are independent scalar and m-vector standard Brownian motion, and ![]() is convergence in distribution.

is convergence in distribution. ![]() is a standard Brownian bridge,

is a standard Brownian bridge, ![]() is a Brownian bridge of a second-level,

is a Brownian bridge of a second-level, ![]() is an m-vector standard demeaned Brownian motion, and

is an m-vector standard demeaned Brownian motion, and ![]() is an m-vector standard demeaned and detrended Brownian motion.

is an m-vector standard demeaned and detrended Brownian motion.

The p-values that are reported for the KPSS test and Shin test are calculated via a Monte Carlo simulation of the limiting distributions, using a sample size of 2,000 and 1,000,000 replications.

Independence tests are widely used in model selection, residual analysis, and model diagnostics because models are usually based on the assumption of independently distributed errors. If a given time series (for example, a series of residuals) is independent, then no deterministic model is necessary for this completely random process; otherwise, there must exist some relationship in the series to be addressed. In the following section, four independence tests are introduced: the BDS test, the runs test, the turning point test, and the rank version of von Neumann ratio test.

Brock, Dechert, and Scheinkman (1987) propose a test (BDS test) of independence based on the correlation dimension. Brock et al. (1996) show that the first-order asymptotic distribution of the test statistic is independent of the estimation error provided

that the parameters of the model under test can be estimated ![]() -consistently. Hence, the BDS test can be used as a model selection tool and as a specification test.

-consistently. Hence, the BDS test can be used as a model selection tool and as a specification test.

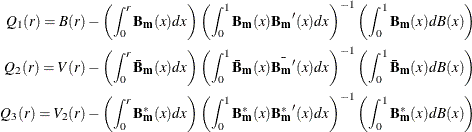

Given the sample size ![]() , the embedding dimension m, and the value of the radius r, the BDS statistic is

, the embedding dimension m, and the value of the radius r, the BDS statistic is

where

The statistic has a standard normal distribution if the sample size is large enough. For small sample size, the distribution can be approximately obtained through simulation. Kanzler (1999) has a comprehensive discussion on the implementation and empirical performance of BDS test.

The runs test and turning point test are two widely used tests for independence (Cromwell, Labys, and Terraza, 1994).

The runs test needs several steps. First, convert the original time series into the sequence of signs, ![]() , that is, map

, that is, map ![]() into

into ![]() where

where ![]() is the sample mean of

is the sample mean of ![]() and

and ![]() is "

is "![]() " if x is nonnegative and "

" if x is nonnegative and "![]() " if x is negative. Second, count the number of runs, R, in the sequence. A run of a sequence is a maximal non-empty segment of the sequence that consists of adjacent equal elements.

For example, the following sequence contains

" if x is negative. Second, count the number of runs, R, in the sequence. A run of a sequence is a maximal non-empty segment of the sequence that consists of adjacent equal elements.

For example, the following sequence contains ![]() runs:

runs:

Third, count the number of pluses and minuses in the sequence and denote them as ![]() and

and ![]() , respectively. In the preceding example sequence,

, respectively. In the preceding example sequence, ![]() and

and ![]() . Note that the sample size

. Note that the sample size ![]() . Finally, compute the statistic of runs test,

. Finally, compute the statistic of runs test,

where

The statistic of the turning point test is defined as follows:

where the indicator function of the turning point ![]() is 1 if

is 1 if ![]() or

or ![]() (that is, both the previous and next values are greater or less than the current value); otherwise, 0.

(that is, both the previous and next values are greater or less than the current value); otherwise, 0.

The statistics of both the runs test and the turning point test have the standard normal distribution under the null hypothesis of independence.

Since the runs test completely ignores the magnitudes of the observations, Bartels (1982) proposes a rank version of the von Neumann Ratio test for independence:

where ![]() is the rank of tth observation in the sequence of

is the rank of tth observation in the sequence of ![]() observations. For large sample, the statistic follows the standard normal distribution under the null hypothesis of independence.

For small samples of size between 11 and 100, the critical values through simulation would be more precise; for samples of

size no more than 10, the exact CDF is applied.

observations. For large sample, the statistic follows the standard normal distribution under the null hypothesis of independence.

For small samples of size between 11 and 100, the critical values through simulation would be more precise; for samples of

size no more than 10, the exact CDF is applied.

Based on skewness and kurtosis, Jarque and Bera (1980) calculated the test statistic

where

The ![]()

![]() (2) distribution gives an approximation to the normality test

(2) distribution gives an approximation to the normality test ![]() .

.

When the GARCH model is estimated, the normality test is obtained using the standardized residuals ![]() . The normality test can be used to detect misspecification of the family of ARCH models.

. The normality test can be used to detect misspecification of the family of ARCH models.

Consider the following linear regression model:

where ![]() is an

is an ![]() data matrix,

data matrix, ![]() is a

is a ![]() coefficient vector, and

coefficient vector, and ![]() is a

is a ![]() disturbance vector. The error term

disturbance vector. The error term ![]() is assumed to be generated by the jth-order autoregressive process

is assumed to be generated by the jth-order autoregressive process ![]() where

where ![]() ,

, ![]() is a sequence of independent normal error terms with mean 0 and variance

is a sequence of independent normal error terms with mean 0 and variance ![]() . Usually, the Durbin-Watson statistic is used to test the null hypothesis

. Usually, the Durbin-Watson statistic is used to test the null hypothesis ![]() against

against ![]() . Vinod (1973) generalized the Durbin-Watson statistic:

. Vinod (1973) generalized the Durbin-Watson statistic:

where ![]() are OLS residuals. Using the matrix notation,

are OLS residuals. Using the matrix notation,

where ![]() and

and ![]() is a

is a ![]() matrix:

matrix:

![\[ \mb{A} _{j} = \begin{bmatrix} -1 & 0 & {\cdots } & 0 & 1 & 0 & {\cdots } & 0 \\ 0 & -1 & 0 & {\cdots } & 0 & 1 & 0 & {\cdots } \\ {\vdots } & {\vdots } & {\vdots } & {\vdots } & {\vdots } & {\vdots } & {\vdots } & {\vdots } \\ 0 & {\cdots } & 0 & -1 & 0 & {\cdots } & 0 & 1 \end{bmatrix} \]](images/etsug_autoreg0636.png)

and there are ![]() zeros between

zeros between ![]() and 1 in each row of matrix

and 1 in each row of matrix ![]() .

.

The QR factorization of the design matrix ![]() yields a

yields a ![]() orthogonal matrix

orthogonal matrix ![]() :

:

where R is an ![]() upper triangular matrix. There exists an

upper triangular matrix. There exists an ![]() submatrix of

submatrix of ![]() such that

such that ![]() and

and ![]() . Consequently, the generalized Durbin-Watson statistic is stated as a ratio of two quadratic forms:

. Consequently, the generalized Durbin-Watson statistic is stated as a ratio of two quadratic forms:

where ![]() are upper n eigenvalues of

are upper n eigenvalues of ![]() and

and ![]() is a standard normal variate, and

is a standard normal variate, and ![]() . These eigenvalues are obtained by a singular value decomposition of

. These eigenvalues are obtained by a singular value decomposition of ![]() (Golub and Van Loan, 1989; Savin and White, 1978).

(Golub and Van Loan, 1989; Savin and White, 1978).

The marginal probability (or p-value) for ![]() given

given ![]() is

is

where

When the null hypothesis ![]() holds, the quadratic form

holds, the quadratic form ![]() has the characteristic function

has the characteristic function

The distribution function is uniquely determined by this characteristic function:

For example, to test ![]() given

given ![]() against

against ![]() , the marginal probability (p-value) can be used:

, the marginal probability (p-value) can be used:

where

and ![]() is the calculated value of the fourth-order Durbin-Watson statistic.

is the calculated value of the fourth-order Durbin-Watson statistic.

In the Durbin-Watson test, the marginal probability indicates positive autocorrelation (![]() ) if it is less than the level of significance (

) if it is less than the level of significance (![]() ), while you can conclude that a negative autocorrelation (

), while you can conclude that a negative autocorrelation (![]() ) exists if the marginal probability based on the computed Durbin-Watson statistic is greater than

) exists if the marginal probability based on the computed Durbin-Watson statistic is greater than ![]() . Wallis (1972) presented tables for bounds tests of fourth-order autocorrelation, and Vinod (1973) has given tables for a 5% significance level for orders two to four. Using the AUTOREG procedure, you can calculate the

exact p-values for the general order of Durbin-Watson test statistics. Tests for the absence of autocorrelation of order p can be performed sequentially; at the jth step, test

. Wallis (1972) presented tables for bounds tests of fourth-order autocorrelation, and Vinod (1973) has given tables for a 5% significance level for orders two to four. Using the AUTOREG procedure, you can calculate the

exact p-values for the general order of Durbin-Watson test statistics. Tests for the absence of autocorrelation of order p can be performed sequentially; at the jth step, test ![]() given

given ![]() against

against ![]() . However, the size of the sequential test is not known.

. However, the size of the sequential test is not known.

The Durbin-Watson statistic is computed from the OLS residuals, while that of the autoregressive error model uses residuals that are the difference between the predicted values and the actual values. When you use the Durbin-Watson test from the residuals of the autoregressive error model, you must be aware that this test is only an approximation. See Autoregressive Error Model earlier in this chapter. If there are missing values, the Durbin-Watson statistic is computed using all the nonmissing values and ignoring the gaps caused by missing residuals. This does not affect the significance level of the resulting test, although the power of the test against certain alternatives may be adversely affected. Savin and White (1978) have examined the use of the Durbin-Watson statistic with missing values.

The Durbin-Watson probability calculations have been enhanced to compute the p-value of the generalized Durbin-Watson statistic for large sample sizes. Previously, the Durbin-Watson probabilities were only calculated for small sample sizes.

Consider the following linear regression model:

where ![]() is an

is an ![]() data matrix,

data matrix, ![]() is a

is a ![]() coefficient vector,

coefficient vector, ![]() is a

is a ![]() disturbance vector, and

disturbance vector, and ![]() is a sequence of independent normal error terms with mean 0 and variance

is a sequence of independent normal error terms with mean 0 and variance ![]() .

.

The generalized Durbin-Watson statistic is written as

where ![]() is a vector of OLS residuals and

is a vector of OLS residuals and ![]() is a

is a ![]() matrix. The generalized Durbin-Watson statistic DW

matrix. The generalized Durbin-Watson statistic DW![]() can be rewritten as

can be rewritten as

where ![]() .

.

The marginal probability for the Durbin-Watson statistic is

where ![]() .

.

The p-value or the marginal probability for the generalized Durbin-Watson statistic is computed by numerical inversion of the characteristic

function ![]() of the quadratic form

of the quadratic form ![]() . The trapezoidal rule approximation to the marginal probability

. The trapezoidal rule approximation to the marginal probability ![]() is

is

where ![]() is the imaginary part of the characteristic function,

is the imaginary part of the characteristic function, ![]() and

and ![]() are integration and truncation errors, respectively. Refer to Davies (1973) for numerical inversion of the characteristic function.

are integration and truncation errors, respectively. Refer to Davies (1973) for numerical inversion of the characteristic function.

Ansley, Kohn, and Shively (1992) proposed a numerically efficient algorithm that requires O(![]() ) operations for evaluation of the characteristic function

) operations for evaluation of the characteristic function ![]() . The characteristic function is denoted as

. The characteristic function is denoted as

where ![]() and

and ![]() . By applying the Cholesky decomposition to the complex matrix

. By applying the Cholesky decomposition to the complex matrix ![]() , you can obtain the lower triangular matrix

, you can obtain the lower triangular matrix ![]() that satisfies

that satisfies ![]() . Therefore, the characteristic function can be evaluated in O(

. Therefore, the characteristic function can be evaluated in O(![]() ) operations by using the following formula:

) operations by using the following formula:

where ![]() . Refer to Ansley, Kohn, and Shively (1992) for more information on evaluation of the characteristic function.

. Refer to Ansley, Kohn, and Shively (1992) for more information on evaluation of the characteristic function.

When regressors contain lagged dependent variables, the Durbin-Watson statistic (![]() ) for the first-order autocorrelation is biased toward 2 and has reduced power. Wallis (1972) shows that the bias in the Durbin-Watson statistic (

) for the first-order autocorrelation is biased toward 2 and has reduced power. Wallis (1972) shows that the bias in the Durbin-Watson statistic (![]() ) for the fourth-order autocorrelation is smaller than the bias in

) for the fourth-order autocorrelation is smaller than the bias in ![]() in the presence of a first-order lagged dependent variable. Durbin (1970) proposes two alternative statistics (Durbin h and t ) that are asymptotically equivalent. The h statistic is written as

in the presence of a first-order lagged dependent variable. Durbin (1970) proposes two alternative statistics (Durbin h and t ) that are asymptotically equivalent. The h statistic is written as

where ![]() and

and ![]() is the least squares variance estimate for the coefficient of the lagged dependent variable. Durbin’s t test consists of regressing the OLS residuals

is the least squares variance estimate for the coefficient of the lagged dependent variable. Durbin’s t test consists of regressing the OLS residuals ![]() on explanatory variables and

on explanatory variables and ![]() and testing the significance of the estimate for coefficient of

and testing the significance of the estimate for coefficient of ![]() .

.

Inder (1984) shows that the Durbin-Watson test for the absence of first-order autocorrelation is generally more powerful than the h test in finite samples. Refer to Inder (1986) and King and Wu (1991) for the Durbin-Watson test in the presence of lagged dependent variables.

The GODFREY= option in the MODEL statement produces the Godfrey Lagrange multiplier test for serially correlated residuals for each equation (Godfrey, 1978b, 1978a). r is the maximum autoregressive order, and specifies that Godfrey’s tests be computed for lags 1 through r. The default number of lags is four.

Ramsey’s reset test is a misspecification test associated with the functional form of models to check whether power transforms need to be added to a model. The original linear model, henceforth called the restricted model, is

To test for misspecification in the functional form, the unrestricted model is

where ![]() is the predicted value from the linear model and p is the power of

is the predicted value from the linear model and p is the power of ![]() in the unrestricted model equation starting from 2. The number of higher-ordered terms to be chosen depends on the discretion

of the analyst. The RESET option produces test results for

in the unrestricted model equation starting from 2. The number of higher-ordered terms to be chosen depends on the discretion

of the analyst. The RESET option produces test results for ![]() 2, 3, and 4.

2, 3, and 4.

The reset test is an F statistic for testing ![]() , for all

, for all ![]() , against

, against ![]() for at least one

for at least one ![]() in the unrestricted model and is computed as follows:

in the unrestricted model and is computed as follows:

where ![]() is the sum of squared errors due to the restricted model,

is the sum of squared errors due to the restricted model, ![]() is the sum of squared errors due to the unrestricted model, n is the total number of observations, and k is the number of parameters in the original linear model.

is the sum of squared errors due to the unrestricted model, n is the total number of observations, and k is the number of parameters in the original linear model.

Ramsey’s test can be viewed as a linearity test that checks whether any nonlinear transformation of the specified independent variables has been omitted, but it need not help in identifying a new relevant variable other than those already specified in the current model.

For nonlinear time series models, the portmanteau test statistic based on squared residuals is used to test for independence of the series (McLeod and Li, 1983):

where

This Q statistic is used to test the nonlinear effects (for example, GARCH effects) present in the residuals. The GARCH![]() process can be considered as an ARMA

process can be considered as an ARMA![]() process. See the section Predicting the Conditional Variance. Therefore, the Q statistic calculated from the squared residuals can be used to identify the order of the GARCH process.

process. See the section Predicting the Conditional Variance. Therefore, the Q statistic calculated from the squared residuals can be used to identify the order of the GARCH process.

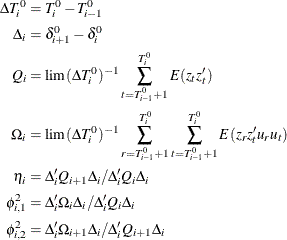

Engle (1982) proposed a Lagrange multiplier test for ARCH disturbances. The test statistic is asymptotically equivalent to the test used by Breusch and Pagan (1979). Engle’s Lagrange multiplier test for the qth order ARCH process is written

where

and

![\[ \mb{Z} = \begin{bmatrix} 1 & \hat{{\nu }}_{0}^{2} & {\cdots } & \hat{{\nu }}_{-q+1}^{2} \\ {\vdots } & {\vdots } & {\vdots } & {\vdots } \\ {\vdots } & {\vdots } & {\vdots } & {\vdots } \\ 1 & \hat{{\nu }}_{N-1}^{2} & {\cdots } & \hat{{\nu }}_{N-q}^{2} \end{bmatrix} \]](images/etsug_autoreg0724.png)

The presample values ( ![]() ,

,![]() ,

, ![]() ) have been set to 0. Note that the LM

) have been set to 0. Note that the LM![]() tests might have different finite-sample properties depending on the presample values, though they are asymptotically equivalent

regardless of the presample values.

tests might have different finite-sample properties depending on the presample values, though they are asymptotically equivalent

regardless of the presample values.

Engle’s Lagrange multiplier test for ARCH disturbances is a two-sided test; that is, it ignores the inequality constraints

for the coefficients in ARCH models. Lee and King (1993) propose a one-sided test and prove that the test is locally most mean powerful. Let ![]() , denote the residuals to be tested. Lee and King’s test checks

, denote the residuals to be tested. Lee and King’s test checks

where ![]() are in the following ARCH(q) model:

are in the following ARCH(q) model:

The statistic is written as

![\[ S=\frac{\sum _{t=q+1}^{T}{(\frac{\varepsilon _ t^2}{h_0}-1)\sum _{i=1}^{q}{\varepsilon _{t-i}^2}}}{\left[2\sum _{t=q+1}^{T}{(\sum _{i=1}^{q}{\varepsilon _{t-i}^2})^2}-\frac{2(\sum _{t=q+1}^{T} {\sum _{i=1}^{q}{\varepsilon _{t-i}^2}})^2}{T-q}\right]^{1/2}} \]](images/etsug_autoreg0733.png)

Wong and Li (1995) propose a rank portmanteau statistic to minimize the effect of the existence of outliers in the test for ARCH disturbances.

They first rank the squared residuals; that is, ![]() . Then they calculate the rank portmanteau statistic

. Then they calculate the rank portmanteau statistic

where ![]() ,

, ![]() , and

, and ![]() are defined as follows:

are defined as follows:

The Q, Engle’s LM, Lee and King’s, and Wong and Li’s statistics are computed from the OLS residuals, or residuals if the NLAG=

option is specified, assuming that disturbances are white noise. The Q, Engle’s LM, and Wong and Li’s statistics have an approximate

![]() distribution under the white-noise null hypothesis, while the Lee and King’s statistic has a standard normal distribution

under the white-noise null hypothesis.

distribution under the white-noise null hypothesis, while the Lee and King’s statistic has a standard normal distribution

under the white-noise null hypothesis.

Consider the linear regression model

where the parameter vector ![]() contains k elements.

contains k elements.

Split the observations for this model into two subsets at the break point specified by the CHOW= option, so that

Now consider the two linear regressions for the two subsets of the data modeled separately,

where the number of observations from the first set is ![]() and the number of observations from the second set is

and the number of observations from the second set is ![]() .

.

The Chow test statistic is used to test the null hypothesis ![]() conditional on the same error variance

conditional on the same error variance ![]() . The Chow test is computed using three sums of square errors:

. The Chow test is computed using three sums of square errors:

where ![]() is the regression residual vector from the full set model,

is the regression residual vector from the full set model, ![]() is the regression residual vector from the first set model, and

is the regression residual vector from the first set model, and ![]() is the regression residual vector from the second set model. Under the null hypothesis, the Chow test statistic has an F distribution with

is the regression residual vector from the second set model. Under the null hypothesis, the Chow test statistic has an F distribution with ![]() and

and ![]() degrees of freedom, where

degrees of freedom, where ![]() is the number of elements in

is the number of elements in ![]() .

.

Chow (1960) suggested another test statistic that tests the hypothesis that the mean of prediction errors is 0. The predictive Chow

test can also be used when ![]() .

.

The PCHOW= option computes the predictive Chow test statistic

The predictive Chow test has an F distribution with ![]() and

and ![]() degrees of freedom.

degrees of freedom.

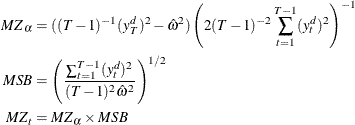

Bai and Perron (1998) propose several kinds of multiple structural change tests: (1) the test of no break versus a fixed number of breaks (![]() test), (2) the equal and unequal weighted versions of double maximum tests of no break versus an unknown number of breaks

given some upper bound (

test), (2) the equal and unequal weighted versions of double maximum tests of no break versus an unknown number of breaks

given some upper bound (![]() test and

test and ![]() test), and (3) the test of l versus

test), and (3) the test of l versus ![]() breaks (

breaks (![]() test). Bai and Perron (2003a, 2003b, 2006) also show how to implement these tests, the commonly used critical values, and the simulation analysis on these tests.

test). Bai and Perron (2003a, 2003b, 2006) also show how to implement these tests, the commonly used critical values, and the simulation analysis on these tests.

Consider the following partial structural change model with m breaks (![]() regimes):

regimes):

Here, ![]() is the dependent variable observed at time t,

is the dependent variable observed at time t, ![]() is a vector of covariates with coefficients

is a vector of covariates with coefficients ![]() unchanged over time, and

unchanged over time, and ![]() is a vector of covariates with coefficients

is a vector of covariates with coefficients ![]() at regime j,

at regime j, ![]() . If

. If ![]() (that is, there are no x regressors), the regression model becomes the pure structural change model. The indices

(that is, there are no x regressors), the regression model becomes the pure structural change model. The indices ![]() (that is, the break dates or break points) are unknown, and the convenient notation

(that is, the break dates or break points) are unknown, and the convenient notation ![]() and

and ![]() applies. For any given m-partition

applies. For any given m-partition ![]() , the associated least squares estimates of

, the associated least squares estimates of ![]() and

and ![]() are obtained by minimizing the sum of squared residuals (SSR),

are obtained by minimizing the sum of squared residuals (SSR),

Let ![]() denote the minimized SSR for a given

denote the minimized SSR for a given ![]() . The estimated break dates

. The estimated break dates ![]() are such that

are such that

where the minimization is taken over all partitions ![]() such that

such that ![]() . Bai and Perron (2003a) propose an efficient algorithm, based on the principle of dynamic programming, to estimate the preceding model.

. Bai and Perron (2003a) propose an efficient algorithm, based on the principle of dynamic programming, to estimate the preceding model.

In the case that the data are nontrending, as stated in Bai and Perron (1998), the limiting distribution of the break dates is as follows:

where

and

Also, ![]() and

and ![]() are independent standard Weiner processes that are defined on

are independent standard Weiner processes that are defined on ![]() , starting at the origin when

, starting at the origin when ![]() ; these processes are also independent across i. The cumulative distribution function of

; these processes are also independent across i. The cumulative distribution function of ![]() is shown in Bai (1997). Hence, with the estimates of

is shown in Bai (1997). Hence, with the estimates of ![]() ,

, ![]() , and

, and ![]() , the relevant critical values for confidence interval of break dates

, the relevant critical values for confidence interval of break dates ![]() can be calculated. The estimate of

can be calculated. The estimate of ![]() is

is ![]() . The estimate of

. The estimate of ![]() is either

is either

if the regressors are assumed to have heterogeneous distributions across regimes (that is, the HQ option is specified), or

if the regressors are assumed to have identical distributions across regimes (that is, the HQ option is not specified). The

estimate of ![]() can also be constructed with data over regime i only or the whole sample, depending on whether the vectors

can also be constructed with data over regime i only or the whole sample, depending on whether the vectors ![]() are heterogeneously distributed across regimes (that is, the HO option is specified). If the HAC option is specified,

are heterogeneously distributed across regimes (that is, the HO option is specified). If the HAC option is specified, ![]() is estimated through the heteroscedasticity- and autocorrelation-consistent (HAC) covariance matrix estimator applied to

vectors

is estimated through the heteroscedasticity- and autocorrelation-consistent (HAC) covariance matrix estimator applied to

vectors ![]() .

.

The ![]() test of no structural break

test of no structural break ![]() versus the alternative hypothesis that there are a fixed number,

versus the alternative hypothesis that there are a fixed number, ![]() , of breaks is defined as follows:

, of breaks is defined as follows:

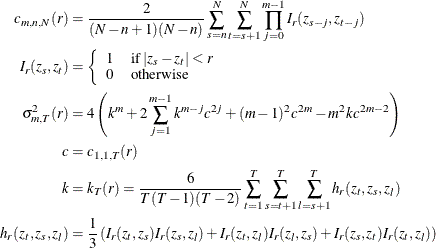

where

![\[ R_{(kq)\times (p+(k+1)q)} = \left( \begin{array}{ ccccccc } 0_{q \times p} & I_ q & -I_ q & 0 & 0 & \cdots & 0 \\ 0_{q \times p} & 0 & I_ q & -I_ q & 0 & \cdots & 0 \\ \vdots & \cdots & \ddots & \ddots & \ddots & \ddots & \cdots \\ 0_{q \times p} & 0 & \cdots & \cdots & 0 & I_ q & -I_ q \end{array} \right) \]](images/etsug_autoreg0793.png)

and ![]() is the

is the ![]() identity matrix;

identity matrix; ![]() is the coefficient vector

is the coefficient vector ![]() , which together with the break dates

, which together with the break dates ![]() minimizes the global sum of squared residuals; and

minimizes the global sum of squared residuals; and ![]() is an estimate of the variance-covariance matrix of

is an estimate of the variance-covariance matrix of ![]() , which could be estimated by using the HAC estimator or another way, depending on how the HAC, HR, and HE options are specified.

The output

, which could be estimated by using the HAC estimator or another way, depending on how the HAC, HR, and HE options are specified.

The output ![]() test statistics are scaled by q, the number of regressors, to be consistent with the limiting distribution; Bai and Perron (2003b, 2006) take the same action.

test statistics are scaled by q, the number of regressors, to be consistent with the limiting distribution; Bai and Perron (2003b, 2006) take the same action.

There are two versions of double maximum tests of no break against an unknown number of breaks given some upper bound ![]() : the

: the ![]() test:

test:

and the ![]() test:

test:

where ![]() is the significance level and

is the significance level and ![]() is the critical value of

is the critical value of ![]() test given the significance level

test given the significance level ![]() . Four kinds of

. Four kinds of ![]() tests that correspond to

tests that correspond to ![]() , and 0.010 are implemented.

, and 0.010 are implemented.

The ![]() test of l versus

test of l versus ![]() breaks is calculated in two ways that are asymptotically the same. In the first calculation, the method amounts to the application

of

breaks is calculated in two ways that are asymptotically the same. In the first calculation, the method amounts to the application

of ![]() tests of the null hypothesis of no structural change versus the alternative hypothesis of a single change. The test is applied

to each segment that contains the observations

tests of the null hypothesis of no structural change versus the alternative hypothesis of a single change. The test is applied

to each segment that contains the observations ![]() to

to ![]()

![]() . The

. The ![]() test statistics are the maximum of these

test statistics are the maximum of these ![]()

![]() test statistics. In the second calculation, for the given l breaks

test statistics. In the second calculation, for the given l breaks ![]() , the new break

, the new break ![]() is to minimize the global SSR:

is to minimize the global SSR:

Then,

The p-value of each test is based on the simulation of the limiting distribution of that test.