The QUANTSELECT Procedure

This simulation study exemplifies the unity of motive and effect for the PROC QUANTSELECT procedure. The following statements generate a data set that is based on a naive instrumental model (Chernozhukov and Hansen, 2008):

%let seed=321;

%let p=20;

%let n=3000;

data analysisData;

array x{&p} x1-x&p;

do i=1 to &n;

U = ranuni(&seed);

x1 = ranuni(&seed);

x2 = ranexp(&seed);

x3 = abs(rannor(&seed));

y = x1*(U-0.1) + x2*(U*U-0.25) + x3*(exp(U)-exp(0.9));

do j=4 to &p;

x{j} = ranuni(&seed);

end;

output;

end;

run;

Variable U of the data set indicates the true quantile level of the response y conditional on ![]() .

.

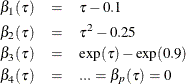

Let ![]() denote the underlying quantile regression model, where

denote the underlying quantile regression model, where ![]() . Then, the true parameter functions are

. Then, the true parameter functions are

It is easy to see that, at ![]() , only

, only ![]() and

and ![]() are nonzero parameters. Therefore, an effective effect selection method should select

are nonzero parameters. Therefore, an effective effect selection method should select ![]() and

and ![]() and drop all the other effects in this data set at

and drop all the other effects in this data set at ![]() . By the same rationale,

. By the same rationale, ![]() and

and ![]() should be selected at

should be selected at ![]() with

with ![]() and

and ![]() , and

, and ![]() and

and ![]() should be selected at

should be selected at ![]() with

with ![]() and

and ![]() .

.

The following statements use PROC QUANTSELECT with the adaptive LASSO method:

proc quantselect data=analysisData;

model y= x1-x&p / quantile=0.1 0.5 0.9

selection=lasso(adaptive);

output out=out p=pred;

run;

Output 84.1.1 shows that, by default, the CHOOSE= and STOP= options are both set to SBC.

The selected effects and the relevant estimates are shown in Output 84.1.2 for ![]() , Output 84.1.3 for

, Output 84.1.3 for ![]() , and Output 84.1.4 for

, and Output 84.1.4 for ![]() . You can see that the adaptive LASSO method correctly selects active effects for all three quantile levels.

. You can see that the adaptive LASSO method correctly selects active effects for all three quantile levels.

The QUANTSELECT procedure can perform effect selection not only at a single quantile level but also for the entire quantile

process. You can specify the QUANTILE=PROCESS option to do effect selection for the entire quantile process. With the QUANTILE=PROCESS

option specified, the ParameterEstimates table produced by the QUANTSELECT procedure actually shows the mean prediction model

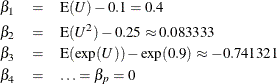

of y conditional on ![]() . In this simulation study, the true mean model is

. In this simulation study, the true mean model is

where

The following statements perform effect selection for the quantile process with the forward selection method.

proc quantselect data=analysisData;

model y= x1-x&p / quantile=process(ntau=all)

selection=forward;

run;

Output 84.1.5 shows that, by default, the SELECT= and STOP= options are both set to SBC. The selected effects and the relevant estimates for the conditional mean model are shown in Output 84.1.6.

Linear regression is the most popular method for estimating conditional means. The following statements show how to select effects with the GLMSELECT procedure, and Output 84.1.7 shows the resulting selected effects and their estimates. You can see that the mean estimates from the QUANTSELECT procedure are similar to those from the GLMSELECT procedure. However, quantile regression can provide detailed distribution information, which is not available from linear regression.

proc glmselect data=analysisData; model y= x1-x3 / selection=forward(select=sbc stop=sbc choose=sbc); run;